Please click for small write-up about OPTION TRADING

Option Open Interest for 28-10-2016

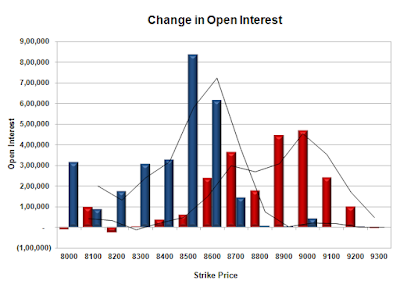

Inference

The index opened flat to positive and after making an initial low around 8581 saw some short covering to close at 8638.00, gain of 22.75 points. The broader market was positive with 982 advances to 656 declines. Range at the start of series at 8500-9000.

- Call option 8500-9200 added 20.90 lacs OI with short covering at 8200 and below strike prices.

- Put option 8700-8000 added 27.99 lacs OI with short covering at 9100 and above strike prices.

- Nifty Open Interest is at 1,77,32,100 down by 2,32,575 with increase in price, probably short covering.

- Bank Nifty Open Interest is at 15,35,560 down by 24,160 with increase in price, probably short covering.

- FII’s sold 17089 contracts of Index Futures, which includes net 8291 contracts long liquidation and 8798 contracts short build-up, with increase in net OI by 507 contracts, includes 17643 longs to 34732 shorts for the day.

- FII’s Index future open contract as on date is 154986 Longs to 51554 Shorts, Net long 103432 contracts.

- Initial support at 8600 with OI of 34.13 lacs and below that at 8500 with highest OI of 40.50 lacs.

- Initial resistance at 8700 with OI of 21.92 lacs and above that at 8800 with OI of 23.95 lacs.

- Day Range as per Option Table is 8570 - 8686 and as per VIX is 8572 - 8704 with 8628 as the Pivot.

Call OI : 28394400

Put OI : 29039325

PCR OI : 1.0227

SMR : 14.33 (Bearish : Option Table stays Neutral with good support coming up around 8500 again, not much resistance moving forward barring off course one at 9000...)

Option Open Interest for 27-10-2016

Inference

The index opened flat and went down to touch the lows at 8550, but support level buying saw the index close flat at 8615.25. The broader market was weak with 545 advances to 1086 declines. Range at the start of series at 8500-9000.

- Call option 8200-9000 added 32.78 lacs OI with profit booking at 9100 and above strike prices.

- Put option 9000-8000 added 46.37 lacs OI.

- Nifty Open Interest is at 1,79,64,675 up by 56,68,800 with no change in price, probably 100% roll-over with huge long/short build-up.

- Bank Nifty Open Interest is at 15,59,720 up by 5,08,360 with increase in price, probably 100% roll-over with huge long build-up.

- FII’s bought 12615 contracts of Index Futures, which includes net 30938 contracts long liquidation and 53817 contracts short covering, with decrease in net OI by 84755 contracts, includes 81112 longs to 68497 shorts for the day.

- FII’s Index future open contract as on date is 163277 Longs to 42756 Shorts, Net long 120521 contracts.

- Initial support at 8500 with OI of 28.01 lacs and below that at 8500 with highest OI of 32.15 lacs.

- Initial resistance at 8700 with OI of 18.30 lacs and above that at 8800 with OI of 22.20 lacs.

- Day Range as per Option Table is 8543 - 8665 and as per VIX is 8552 - 8679 with 8597 as the Pivot.

Call OI : 26021550

Put OI : 25403400

PCR OI : 0.9762

SMR : 14.43 (Bearish : New series opens with a slight Bearish note within range of 8500-9000, holding today’s low is important for the Bulls to stay in the race...)

Option Open Interest for 26-10-2016

Inference

The index opened weak and stayed weak for the entire session of trade to close near the lows at 8615.25, loss of 76.05 points. The broader market was weak with 542 advances to 1099 declines. Expiry Range is at 8500-8700.

- Call option 8600-8800 added 34.53 lacs OI with profit booking at 8900 and above strike prices.

- Put option 8550 added 8.19 lacs OI with short covering at 8600 and above strike prices.

- Nifty Open Interest is at 1,23,74,400 down by 16,54,425 whereas Nov series added 34.77 lacs OI with decrease in price, probably 100% roll-over with huge short build-up.

- Bank Nifty Open Interest is at 11,96,000 down by 5,04,320 whereas Nov series added 2.70 lacs OI with decrease in price, small roll-over with huge long liquidation.

- FII’s sold 4751 contracts of Index Futures, which includes net 3887 contracts long build-up and 8638 contracts short build-up, with increase in net OI by 12525 contracts, includes 91880 longs to 96631 shorts for the day.

- FII’s Index future open contract as on date is 194215 Longs to 96573 Shorts, Net long 97642 contracts.

- Initial and best support at 8500 with OI of 50.79 lacs and below that at 8400 with OI of 35.97 lacs.

- Initial resistance at 8650 with huge OI addition of 14.88 lacs and above that at 8700 with OI of 51.72 lacs.

- Day Range as per Option Table is 8561 - 8680 and as per VIX is 8550 - 8680 with 8623 as the Pivot.

Call OI : 38921625

Put OI : 33169125

PCR OI : 0.8522

SMR : 16.96 (Bearish : Bears have taken control on the penultimate day of Expiry with the range boiling down to 8550-8680...)

Option Open Interest for 25-10-2016

Inference

The index opened positive but was unable to sustain the highs and went on to the lows around 8663.45 but closed a bit higher at 8691.30, loss of 17.65 points. The broader market was negative with 679 advances to 952 declines. Range stays at 8500-8800.

- Call option 8700-8900 added 9.66 lacs OI with profit booking at 9000 and above strike prices.

- Put option 8500-8400 added 2.02 lacs OI with short covering at 8700 and above strike prices.

- Nifty Open Interest is at 1,40,28,825 down by 25,69,200 whereas Nov series added 34.44 lacs OI with decrease in price, probably 100% roll-over with huge long liquidation.

- Bank Nifty Open Interest is at 17,00,320 down by 1,21,720 whereas Nov series added 3.30 lacs OI with increase in price, probably 100% roll-over with huge long build-up.

- FII’s sold 11678 contracts of Index Futures, which includes net 3609 contracts long liquidation and 8069 contracts short build-up, with increase in net OI by 4460 contracts, includes 99004 longs to 110682 shorts for the day.

- FII’s Index future open contract as on date is 190328 Longs to 87935 Shorts, Net long 102393 contracts.

- Initial and best support at 8600 with OI of 56.07 lacs and below that at 8500 with OI of 54.04 lacs.

- Initial resistance at 8800 with OI of 59.49 lacs and above that at 8900 with OI of 42.26 lacs.

- Day Range as per Option Table is 8633 - 8752 and as per VIX is 8625 - 8757 with 8692 as the Pivot.

Call OI : 37534275

Put OI : 38447100

PCR OI : 1.0243

SMR : 14.14 (Bullish : Frustrating day for market participants, as the index stay in a small range, probable expiry within the limits of 8600-8800 ...)

Option Open Interest for 24-10-2016

Inference

The index opened positive and stayed positive making a high of 8736.95 but closed a DOJI at 8708.95, gain of 15.90 points. The broader market was positive with 936 advances to 701 declines. Range stays at 8500-8800.

- Call option 8800-9100 added 8.15 lacs OI with short covering at 8700 and below strike prices.

- Put option 8700-8300 added 12.13 lacs OI with profit booking at 8200 and below strike prices.

- Nifty Open Interest is at 1,65,98,025 down by 16,30,125 whereas Nov series added 19.15 lacs OI with increase in price, probably 100% roll-over with huge long build-up.

- Bank Nifty Open Interest is at 18,22,040 down by 20,440 whereas Nov series added 1.44 lacs OI with increase in price, probably 100% roll-over with huge long build-up.

- FII’s sold 2704 contracts of Index Futures, which includes net 8969 contracts long build-up and 6265 contracts short build-up, with increase in net OI by 15234 contracts, includes 46191 longs to 43487 shorts for the day.

- FII’s Index future open contract as on date is 193937 Longs to 79866 Shorts, Net long 114071 contracts.

- Initial and best support at 8600 with OI of 57.62 lacs and below that at 8500 with OI of 53.27 lacs.

- Initial resistance at 8800 with OI of 58.45 lacs and above that at 8900 with OI of 38.11 lacs.

- Day Range as per Option Table is 8648 - 8772 and as per VIX is 8644 - 8774 with 8710 as the Pivot.

Call OI : 37712100

Put OI : 40055100

PCR OI : 1.0621

SMR : 13.49 (Bullish : Bullish bias has gained strength in the last few days, though still within the smaller range of 8600-8800, but an Expiry around 8800 is possible...)

SMR Ratio is otherwise known as smart money ratio indicator

SMR = India VIX / PCR

SMR = Smart Money Ratio

India Vix = Volatility Index based on nifty option contracts

PCR = Near month Put Call Ratio based on OI

How to read SMR

SMR is a measure of fear in the market. A value of less than 12 indicates that market is lack of fear and volatility and the higher PCR ratio(greater than 1) supports such kind of action. And a value of 20 or greater indicates too much of fear in the market which is highly motivated with lower PCR ratio (less than 1). It is a kind of indicator which provides information about which kind of market we are right now.