Nifty closed the day at 5116.25 up by 22.50 points. Nifty February Future closed at 5093, premium of 7.05 points.

- FII bought in index futures, index options, and cash but sold in stock futures (Net buy 519.5 Crore)

- US market ended in GREEN.

- Global cues are flat to Positive.

- SGX nifty is Positive as of now.

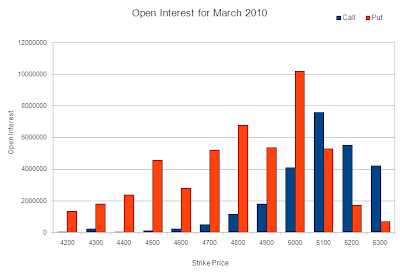

- Most Active March Nifty Call Option: 5100 and 5200.

- Most Active February Nifty Put Options: 5000 and 5100.

Yesterday in intraday Nifty has formed “Deliberation Pattern” which is a bearish candlestick pattern and we saw some selling after that. Daily chart has formed “Long Legged Doji” which suggests uncertainty at higher level and volume was quite low yesterday. Daily momentum indicators are also suggesting uncertainty. On positive side 20 days EMA has given positive cross over to 50 days EMA and important point to note here is that market is note falling and it is just consolidating.

NIFTY Technical

Current Spot: 5116.25

Pivot: 5115.20

3DEMA: 5108

7DEMA: 5070

20DEMA: 4990

RSI (7 days): 75.87

Supports: 5093 - 5070

Resistance: 5138 - 5161

Option Open Interest

Target Nifty

Buy Nifty above 5122 - 5137 - 5159 - 5181 SL - 5115

Sell Nifty below 5110 - 5099 - 5076 - 5055 SL - 5120

Option & Futures Call

Buy Nifty 5000PE at 36.3 for targets of 52, 59 SL of 30 (1-2 Days)

Stock Ideas for the Day

Reliance Industries: Buy above 1011 for targets of 1018, 1033, 1049 SL of 1003

Reliance Industries: Sell below 1001 for targets of 995, 979, 965 SL of 995

Orbit Corporation Ltd.: Buy above 299 for targets of 307, 317 SL of 288

JK Tyre: Buy above 195 for targets of 199, 204 SL of 190

Coromandel Fertilizers: Buy above 310 for targets of 317, 325 SL of 303

Acc: Sell below 1009 for targets of 1004, 997 SL of 1016

Positional Call

SesaGoa: Buy above 440 for targets of 461 SL of 430 (One Week)

The first rule is not to lose. The second rule is not to forget the first rule - WB

Use strict STOP LOSS in each and every trade in this kind of volatile market and Trade at your own risk.

Thanks and Regards

S&P Wealth Creators

Call 09831497250 or mail us @ S&P Wealth Creators with your Name and Mobile No. for subscription offer of intraday calls during Market hours.

Disclaimer

The calls given here are My Personal views, trading or investing in stocks is a high risk activity. Any action you choose to take in the markets is totally your own responsibility. S&P Wealth Creators will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of this information.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert’s stock analysis or opinion.

0 comments:

Post a Comment

Please leave your comments here...