Nifty closed the day at 5249.10 down by 13.35 points. Nifty April future closed at 5263.95, premium of 14.85 points.

- FII bought in Cash (Net buy 433.52 Crore)

- FII sold in index options, stock futures and index futures (Net sell 1101.72 Crore)

- DII sold in Cash (Net sell 356.58 Crore)

- US market ended flat.

- Global cues are flat to Positive.

- SGX nifty is Positive as of now.

- Most Active April Nifty Call Option: 5400 and 5300.

- Most Active March Nifty Put Options: 5200 and 5300.

- Put Call ratio stands at 0.96

Over all view

Detailed study of intraday chart suggests that Nifty has experienced supply side pressure at higher level and finally daily chart has formed “High wave” pattern with longer upper shadow, which favors bear at this point of time as this occurred after yesterday’s “bearish engulf” a bearish candlestick pattern. Daily momentum indicators are showing more weakness. Over all technical scenario remains bearish as Long as nifty is trading below 5300 level on closing basis

NIFTY Technical

Current Spot: 5262.45

Pivot: 5259

3DEMA: 5261

7DEMA: 5253

20DEMA: 5178

RSI (7 days): 58.91

Supports: 5225 - 5201

Resistance: 5284 - 5318

Target Nifty

Buy Nifty above 5272 - 5388 - 5316 - 5359 SL - 5265

Sell Nifty below 5254 - 5242 - 5219 - 5191 SL - 5270

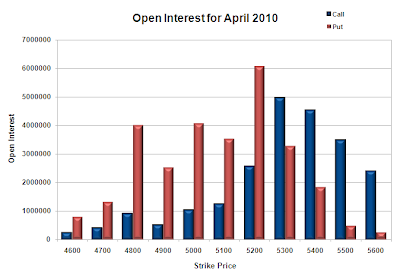

Option Open Interest

Today there is a huge Open Interest buildup in 5200PE April Strike price indicating that Option writers are confident about holding 5200 for time being.

Option & Futures Call

Buy Nifty 5300CE above 89.2 for targets of 97.1, 111.6.4 SL - 83.8

Swing Trade

TV-18 (75.90)

Stock was in accumulation zone from the low of 72, tested in mid March and yesterday stock has formed “Long White Candle” a bullish candlestick pattern with strong volume breakout on daily chart. 3 Days EMA has given positive crossover to 8 days EMA and also closed above 20 days EMA, suggests upward movements is likely to continue. Daily momentum indicators are featuring in bullish zone. Weekly RSI has also given positive crossover to signal line. Looking at all above technical parameters trader with moderate risk appetite can consider Buy above 76.50 with tight Stop loss of 73.50 for a Target of 82.

Stock Ideas for the Day

Reliance Industries: Buy above 1086 for targets of 1089, 1101, 1110 SL of 1077

Reliance Industries: Sell below 1069 for targets of 1064, 1059, 1044 SL of 1083

Natco Pharma: Buy above 133 for targets of 136, 140 SL of 131

Cholamandalam DBS: Buy above 92 for targets of 94, 96 SL of 90.1

TVS Motor: Buy above 82.8 for targets of 85, 87.5 SL of 80.5

Positional Call

BGR Energy: Buy above 541 for target of 572 SL of 527 (One Week)

IDFC: Buy above 160 for target of 169 SL of 157 (One Week)

Use strict STOP LOSS in each and every trade in this kind of volatile market and Trade at your own risk.

Thanks and Regards

S&P Wealth Creators

Call 09831497250 or mail us @ S&P Wealth Creators with your Name and Mobile No. for subscription offer of intraday calls during Market hours.

0 comments:

Post a Comment

Please leave your comments here...